China is home to the world's second-largest market for dairy products after the United States. While dairy has not traditionally formed a part of the staple diet in China, the significant increase in incomes and living standards over the last four decades has helped make milk and dairy an increasingly common feature at the dining table. Today, milk and dairy are viewed as a crucial component of a healthy diet, particularly for children.

Despite the increase in dairy consumption in China since the 1980s, the market still has considerable room for growth. Absolute sales and consumption figures continue to surpass most other markets, but per-capita consumption remains significantly lower than in other middle- and high-income countries. Moreover, wealthier urban households consume dairy at much higher rates than rural households, meaning a large part of the population remains underserved.

As the market has grown, various trends have emerged that are shaping the industry landscape. Whereas milk was previously mainly consumed in powdered form, pasteurized fresh milk and ultra-high temperature (UHT) milk have now become the most popular product segment. The rise in coffee consumption and the proliferation of milk tea stores are also driving the consumption of both fresh and powdered milk. Meanwhile, smaller market segments, such as cheese and butter, are also on the rise, thanks in large part to the increasing popularity of home baking and premium Western food products among wealthier urban households.

Overview of the dairy industry in China

China's dairy industry is estimated to have exceeded RMB 500 billion (US$69.6 billion) in 2023, per projections from the China Business Industry Research Institute.

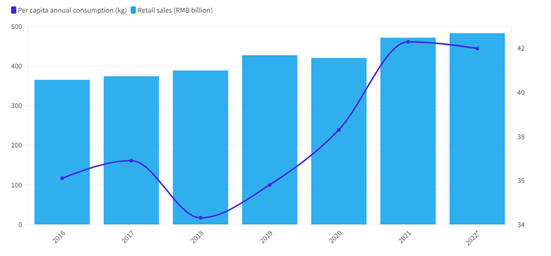

Meanwhile, according to a report by the Huajing Industrial Research Institute, retail sales grew by an average CAGR of 5.3 percent between 2016 and 2021 and are expected to maintain a CAGR of around 4.8 percent between 2022 and 2026 to reach RMB 596.65 billion (US$83 billion).

Demand for dairy products has risen steadily in China across the last decade, as seen by gradual increases in dairy sales and consumption. In 2021, total retail sales of dairy products reached RMB 468.7 billion (US$65.2 billion), according to the China Business Industry Research Institute.

Growth in Demand for Dairy Products in China

Source: China Dairy Quality Report, Ministry of Agriculture and Rural Affairs, 2022-2027 China Dairy Industry Market Operation Status and Investment Planning Suggestions Report, Huajing Industrial Research Institute • *2022 retail sales is an estimate

Meanwhile, the per capita consumption of dairy rose from 36.1 kg per person in 2016 to 42 kg per person in 2022, per data from the Ministry of Agriculture and Rural Affairs (MARA). This is only around half the annual per capita dairy consumption of South Korea and less than a fifth of that of the US.

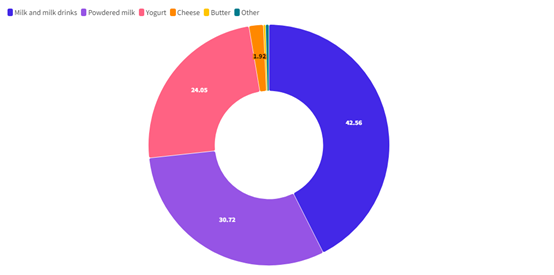

Fresh milk and milk-based drinks form the largest segment of the dairy market, accounting for 42.5 percent of dairy consumed in 2021, according to the China Business Industry Research Institute. This is followed by powdered milk, accounting for around 32 percent of dairy consumed, and yogurt at 24 percent.

Breakdown of Dairy Consumption by Product, 2021

Source: China Business Industry Research Institute

The fastest-growing market segment in China is low-temperature pasteurized milk, more commonly known as fresh milk. According to Founder Securities Research Institute, the market grew at a CAGR of 9.4 percent between 2018 and 2022, outpacing the other liquid milk segments, and reached RMB 39.1 billion (US$5.4 billion) in 2022.

The yogurt market is experiencing similarly rapid growth, experiencing a CAGR of 8.4 percent between 2016 to 2021 according to the China Yogurt Industry Development Trend Analysis and Investment Prospects Research Report (2023-2030). The sector is estimated to have reached RMB 171.33 billion (US$23.8 billion) in 2022.

Within the powdered milk sector, a split has emerged in the demand for infant milk formula and adult milk powder. The infant formula market in China has begun to see a slight decrease in recent years due to declining birth rates, as well as an increasing preference for breastfeeding over bottle feeding with infant formula. According to research from Euromonitor, while the market grew at a healthy rate of 7.9 percent from 2018 to 2019, it slowed to 0.5 percent from 2019 to 2020 before contracting by 2 percent between 2021 and 2022.

However, the outlook of the adult powdered milk industry is much brighter. Thanks in part to increasing demand among middle-aged people, the market size of the adult powdered milk segment is projected to grow from RMB 18 billion (US$2.5 billion) in 2021 to around RMB 20 billion (US$2.8 billion) in 2022.

Supply of dairy products

China's domestic production of dairy has increased substantially in recent decades, following the uptick in consumption. The number of dairy cows in China has increased from 5.7 million dairy cows in 2001 to 7.1 million in 2023. The bulk of China’s milk production is located in north and northeastern China, in particular in Inner Mongolia, Heilongjiang, Hebei, Ningxia, Shaanxi, and Shanxi provinces.

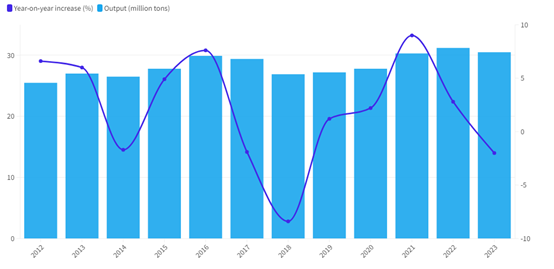

China’s domestic output of cow's milk and dairy products has risen steadily in recent decades, with dairy product output growing at a CAGR of 1.5 percent from 2012 to 2023. In 2023, China produced around 30.5 million tons of dairy, according to the National Bureau of Statistics (NBS). Meanwhile, the production of milk reached a total of 39.31 million tons in 2022, up from around 30 million tons in 2013.

Output of Dairy Products in China

Source: China National Bureau of Statistics, China Briefing

The one exception to the growth in production is the powdered milk segment. The domestic output of powdered milk dropped from 1.6 million tons in 2013 to under 1 million tons in 2022. This has partly been attributed to falling domestic demand as a result of the declining birth rates.

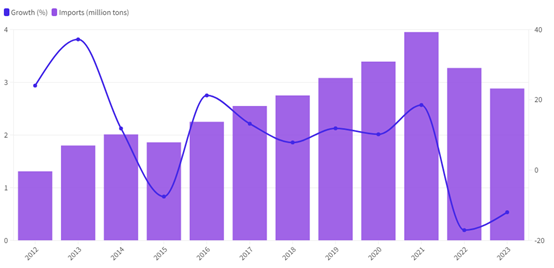

While China has increased its domestic supply of dairy, the country continues to import large amounts of dairy products and milk from other countries. Imports of dairy dropped in 2022 and 2023, following the trend of generally low imports during these years due to a drop in domestic demand. Nonetheless, dairy imports have risen steadily from 1.3 million tons in 2013, to a peak of 3.95 million tons in 2021.

China Dairy Imports

Source: China International Import Expo Exhibitor Alliance Dairy Industry Professional Committee, Dairy Economics Research Office of the National Dairy Industry Technology System

The top source countries for imported dairy products by volume are New Zealand, the US, the Netherlands, and Australia. New Zealand alone accounted for 43.2 percent of China's total dairy imports in 2022, according to research published by the China Animal Husbandry Magazine. The US accounted for the second-largest portion, at 18.1 percent of total imports.

Within the fresh milk segment, China's dairy industry is dominated by domestic brands. The single largest dairy company is the Inner Mongolian Yili Group, which in 2022 had a market share of 21.2 percent, according to data from Euromonitor. The second-largest market player is Mengniu Dairy, also from Inner Mongolia, which held around 16.3 percent market share in 2022. The largest company for Chinese imports of dairy is the New Zealand company Fonterra, with China accounting for around one-third of the company’s exports.

Among other segments, some foreign brands are also dominant players. In the ice cream segment, for instance, the Uniliver-owned Wall's brand comes second by market share after Yili. Meanwhile, in the much more fragmented yogurt segment, Nestle, Danone, and Yakult are among China's top five providers, along with Yili and Mengniu.

In the cheese segment, many foreign brands enjoy a high level of recognition, with products from Laughing Cow, Anchor, Kraft Foods, President, Bridel, and Mainland frequently having shelf space in Chinese supermarkets.

Government policy

The growth of China's dairy market has been spurred in large part by government support. The Chinese government has long framed dairy products as an important element in developing the economy and society. In particular, dairy products have been highlighted as one of the food products that can help China achieve food security, due to its relatively low resource requirements compared to the production of meat.

In recent years, the government has sought to increase the domestic production of dairy to reduce the reliance on imports.

In a set of opinions released in 2018, the State Council set out a range of goals to increase the production of dairy by opening up new areas of the country to milk production, such as the south of China, improving cattle breeding systems, and implementing technologies such as the Internet of Things (IoT) to the production to improve efficiency.

The opinions also stressed the importance of improving the regulatory environment and ensuring that domestically produced milk adheres to high standards, addressing past safety and quality issues that have appeared in production lines. The opinions also called for efforts to bolster the image of the dairy industry in China by publicizing achievements in farming, processing, and quality supervision in order to enhance consumer trust and confidence in domestic products.

In February 2022, MARA released the "14th Five-Year Plan" Action Plan for Improving the Competitiveness of the Dairy Industry, which sets out a range of goals for the development of the dairy industry. These include increasing the production output of dairy products to 41 million tons by 2025.

Among the measures proposed to boost the dairy industry in the plan is to increase capital investment. The plan calls on local governments to coordinate the use of central and local fiscal subsidies, financial capital, and other channels of funding support to support local industries. Governments are also encouraged to support companies to enhance the dairy industry’s competitiveness through methods such as mergers and acquisitions and equity participation.

In order to match supply and demand, the plan will harness the role of consumption in driving production development, strengthen public welfare and popular science promotion, showcase the "fresh" advantages of domestic milk sources, promote diversification and localization of dairy consumption, and enhance the competitiveness of the dairy industry.

Since January 1, 2018, all infant formula products, whether manufactured in China or imported into the country, have been required to obtain a registration certificate from the State Administration for Market Regulation (SAMR), which must be visibly displayed on the product's label and instruction booklet.

In January 2023, the SAMR introduced new regulations on registering the recipes of infant formula. The new regulations include strict formula registration and inspection requirements, as well as enhanced labeling standards and consumer protection requirements.

Opportunities in the dairy industry in China

China's dairy industry offers diverse opportunities across various market segments. In the liquid milk segment, there is considerable opportunity for premiumization, where companies can cater to health-conscious consumers by offering organic, grass-fed, or specialty milk products. Moreover, the demand for fortified milk products, enriched with vitamins, minerals, and functional ingredients, presents an avenue for companies to meet the specific health needs of consumers.

While the market is considerably smaller, imported cheese continues to enjoy strong demand, especially premium varieties from Europe and other renowned cheese-making regions. Similarly, there's a growing market for high-quality butter, appealing to consumers seeking high-quality ingredients for culinary endeavors.

Chinese consumers have long had a taste for probiotic yogurt and other fermented dairy items as an awareness of gut health has grown. The sustained growth and relative fragmentation of the yogurt sector compared to other dairy sectors also allows for more competition, and there is ample room for innovation in flavors and formats to cater to consumers’ evolving preferences for variety and novelty.

While the infant formula industry has been on the decline, demand for adult powdered milk continues to grow, presenting an opportunity for companies to offer premium, high-quality products sourced from trusted suppliers.

In the food service and hospitality sector, there's a demand for reliable dairy supply chain solutions to meet the needs of restaurants, cafes, hotels, and catering services. Additionally, customized dairy products tailored to specific requirements in terms of flavor profiles, packaging formats, and shelf stability are sought after by food service providers.

Source: China Briefing

Note: This article is compiled by Antion. Please indicate the source for reprint.