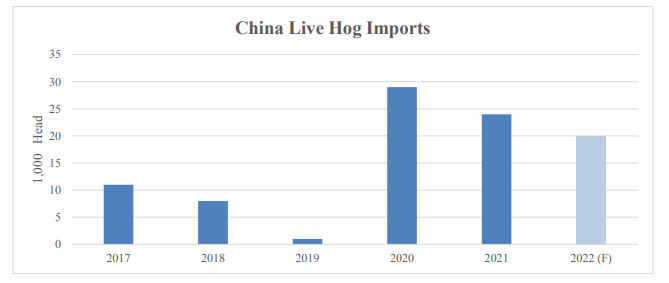

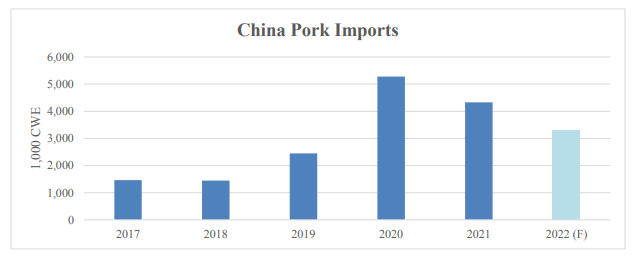

In 2022, imports of breeding swine are estimated lower at 20,000 head and pork imports are estimated at 3.3 million metric tons (MMT). Domestic swine, breeding sows, and pork production are expected to exceed 2021 levels as producers increasingly compete for market share and morbidity associated with African Swine Fever (ASF) outbreaks, lowers. Consequently, and with weaker consumer demand in anticipation of a less robust economic outlook, domestic pork prices should remain low in 2022. Consumer demand for imported beef products and expanded exports of live cattle by South American countries will increase imports to 3.1 MMT and 375,000 head, respectively.

Swine Imports: Imports of live breeding swine in 2022 are estimated lower at 20,000 head as producers clear through 2021 supply levels. Low hog and piglet prices that continued into 2022 are expected to lower demand for imported breeding swine.

Pork Imports: The 2022 pork import estimate is lowered to 3.3 MMT due to competition from lowpriced domestic pork, a pork import tariff increase (from 8 to 12 percent), less optimistic economic outlook, and continued COVID-19 related restrictions and market disruptions.

Cattle Imports: The 2022 cattle imports are estimated to rise to 375,000 head, on increased imports from South America.

Beef Imports: The import of beef for 2022 is estimated to rise to 3.1 MMT. The rate of increase is expected to be slower than in 2021 due to a less optimistic economic outlook and COVID-19 restrictions, but still 3 percent increase over 2021.

SWINE

2022 live swine imports expected to decline as sow herd stabilizes

In 2022, live swine imports are expected to decline to 20,000 head. Live swine imports have historically been relatively low and recent growth was spurred by the desire to improve herd genetics while pork prices were high (see CHART 3 below). However, costs for transporting, testing, and delivering imported hogs are reportedly unrealistic for China's hog producers at current hog prices. Reports indicate that some large producers are establishing "nuclear" herds to centralize breeding within their facilities (those producers increasingly focused on vertical integration), while others have returned to relying on breeders to supply piglets.

In 2022, live hog imports will be dominated by long-term partners such as the United States, Demark, France, and the United Kingdom. In September 2021, Ireland signed an agreement with the General Administration of Customs of the People's Republic of China (GACC) to ship breeding swine. Industry sources note that breeding swine from the United States are preferred because of hog size, higher survival rates, and higher meat production efficiency rates. Danish-origin breeding swine are popular due to higher rates of piglet production, on average, over the life span of the breeding sow.

Swine import and export estimates for 2021 are revised from USDA official data based on information from China Customs.

CHART 3. China: Live Hog Imports expected to decline in 2022

Source: Trade Data Monitor (TDM) and Post estimate

PORK

2022 Imports estimated to decline on large domestic pork volume and low domestic prices

In 2022, pork imports are expected to decline 24 percent to 3.3 MMT – on abundant supplies of domestic pork selling at low prices. Additional factors that may dampen imports include China's increase of import tariffs on pork products from 8 to 12 percent (see footnote 2, above) and a less optimistic outlook for the economy in 2022. However, imports, are expected to remain historically elevated as consumers become accustomed to purchasing chilled and frozen imported pork products through HRI and retail channels (see CHART 5 below).

In 2022, international shipping issues are anticipated to remain a challenge for imports, though to a lesser degree than in 2021. Shortages in refrigerated containers, COVID-19 testing and disinfection procedures, and centralized warehousing for imported products will contribute to the shipping challenges facing importers by adding costs and delays to customs clearance.

The five major pork suppliers are expected to remain Spain, Brazil, the United States, Denmark, and the Netherlands. These exporting countries provide pork products that are high quality and competitively priced for the China market. Sources report that U.S. pork is expected to remain popular due to stable supplies and consumers preference for the meats' sweeter taste. Other major supplying countries have advantages such as lower trimming/waste rate and higher lean meat rate.

On January 7, 2022, Italy suspended exports of Italian pork and pork products following a detection of ASF. German pork, which reported ASF outbreaks in September 2020, remains suspended from the Chinese market.

Pork import and export estimates for 2021 are revised to reflect official information from China Customs.

CHART 5. China: Pork Imports are estimated to decline in 2022

Source: TDM and Post estimate Other adjustments for imports

Other adjustments for imports

In December 2021, GACC announced that starting on January 1, 2022, a consignee of imported meat will no longer be required in order to import meat products. This change provides an opportunity for a range of new companies to import meat products. For example, large restaurants with multiple outlets, which were previously unable to import products directly from overseas may now apply to import meat products. This regulatory change is unlikely to impact the volume of imports but may increase the number of companies that import products directly and provide greater access to imported products for the HRI sector.

CATTLE

Imports estimated to rise to 375,000 head on expanded exports from South America

The 2022 cattle import estimate is revised higher to 375,000 head, on increased exports from New Zealand, Chile, Uruguay, and Laos. Cattle imports to China from Australia decreased by over 20 percent year-on-year in 2021.

Imported live cattle to China are composed of beef and dairy cattle. Beef cattle typically account for roughly 20-30 percent of imported live cattle. Imported beef cattle fall into two buckets: cattle for slaughtering purpose and cattle for breeding purpose.

China's beef cattle are overwhelmingly domestic breeds. Live cattle imports for breeding purposes are mainly used to improve the herd quality in large-scale and professionally managed beef cattle operations. Beef from imported beef cattle typically is targeted for the higher-end beef market. Some local governments have provided producer subsidies to incorporate imported cattle in breeding programs to improve herd quality.

Cattle import and export estimates for 2021 are revised based on official information from China Customs.

BEEF

Beef import trade estimate revised to 3.1 MMT on consumer demand for imported products

The 2022 beef import estimate is revised to 3.1 MMT. The rate of increase over 2021 is expected to be slower than previous years as the economic outlook for China is less optimistic. Imported beef, like other imported cold-chain products, is expected to face shipping and logistics challenges, including COVID-19 testing, disinfection, and documentation requirements as well as shortages in refrigerated containers. Frozen beef is expected to dominate the market as longer customs clearance times make chilled imported products riskier to source.

In 2022, Brazil is expected to remain the largest beef supplier following China's removal of restrictions on beef products in December 2021. Importers of Australian beef products are facing additional facility suspensions and difficulties clearing product. However, Australian beef remains competitive in China. Argentina has extended domestic beef export restrictions through the end of 2023. The restricted products for exports include seven popular beef cuts and cattle carcasses. Examples of imported beef for sale in high-end supermarkets is in IMAGES 7 and 8, below.

Beef import and export estimates for 2021 are revised to reflect official information from China Customs.

The loss of supply from Australia and Argentina could be met by other exporting countries such as the United States, Uruguay, and New Zealand. In 2021, China engaged with Uruguay on a free trade agreement. On February 23, 2022, China updated the list of beef products available for import from Chile, including certain cattle by-products. Over 80 percent of beef exports from Chile go to China. U.S. beef products have seen tremendous growth over the last two years but occupy a relatively small share of the market. China's demand for a stable supply of high-quality beef is expected to keep demand for U.S. beef strong in 2022.

Please click the link below to access the report:

Source: China Daily

Note: This article is compiled by Antion, please indicate our source if reprint it.