China's infant formula market has grown due to a rising middle class, lower breastfeeding rates, and new policies. Concurrently, there is intense competition between local and international infant formula brands, along with the introduction of new regulatory standards. We discuss how foreign companies can successfully bring their infant formula products to this market.

Over the past few years, the overall market for Chinese infant formula has continued to grow, despite a slower rate of expansion. This growth is primarily driven by the country's substantial population and expanding middle class, declining rates of breastfeeding, and the influence of China's "three-child policy".

The dynamics of the market have ignited fierce competition among both international and domestic Chinese infant formula brands. Consequently, new regulations for infant formula product registration have been introduced this year. Foreign brands that want to establish themselves in this sector must understand how the new compliance norms apply to them and adhere to critical reporting requirements.

Market analysis

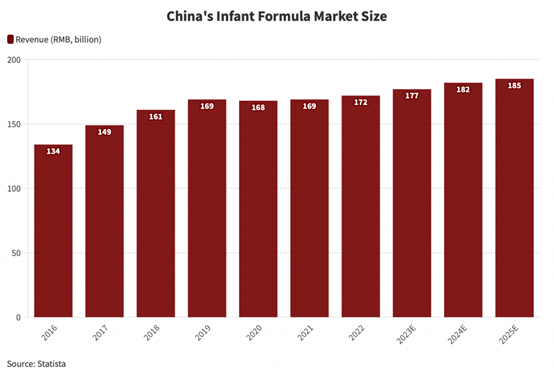

Data suggests that the Chinese infant formula market was projected to achieve a value of approximately RMB 172 billion (US$23.6 billion) in 2022.

Leading segments

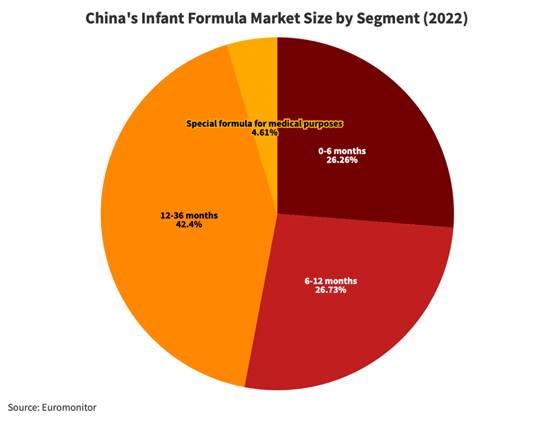

Looking at the breakdown of China's infant formula market by different age groups, it’s clear that the baby stage, which includes the first and second stages (ages 0-12 months), makes up more than half of the market share. The toddler stage, which covers the third stage (ages 12-36 months), along with other stages (3-6 years), accounts for 47 percent of the market.

Within the baby stage, the first and second stages are almost equal, comprising 26.3 percent and 26.7 percent, respectively. The third stage makes up 42.4 percent of the market. Despite the third stage covering twice the time span of the first and second stages combined, its actual consumer market size isn't twice as big. This is because, after the second stage (12 months), some parents opt for other foods to replace or supplement formula feeding. Additionally, as children reach 36 months, many parents stop using formula altogether.

Key distribution channels

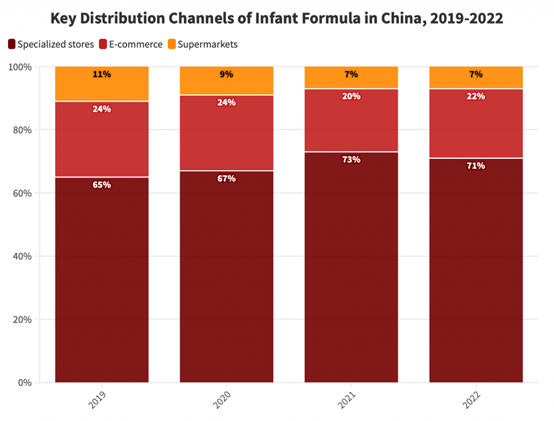

Looking at the distribution channels for maternal and infant formula consumption in recent years in China, it's evident that specialized stores for mothers and babies have consistently accounted for the majority of consumption, ranging between 65 percent to 73 percent over four years. In contrast, offline supermarkets have shown a clear decline, dropping from 11 percent to 7 percent steadily.

Online e-commerce channels maintained a 24 percent share in both 2019 and 2020, with a slight dip to 20 percent in 2021. However, they rebounded to 22 percent in 2022, primarily due to the rapid growth of short videos, livestream shopping, and the rise of content-driven e-commerce.

Notably, the phenomenon of market concentration is particularly pronounced in online e-commerce, especially in cross-border e-commerce channels. Leading businesses in these channels are known for their stable product quality and longstanding reputation, making them among the most important factors for maternal and infant formula consumers when making purchasing decisions. Additionally, factors such as convenient logistics and prices lower than offline stores are also significant incentives influencing consumer decisions in favor of online channels.

Market share

Foreign brands once occupied almost 60 percent of China's infant formula market share.

With time, China's market regulations have become stricter and the quality of locally-made baby formula has improved, resulting in the growth of the popularity of domestic brands. By 2022, among the top five infant formula brands in China, three were Chinese firms.

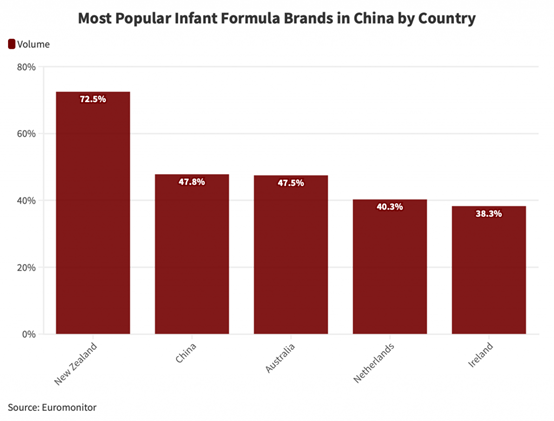

When it comes to the country of origin of infant formula products, most Chinese consumers (72.5 percent) still prefer New Zealand. China and Australia are next, with 47.8 percent and 47.5 percent, respectively. The Netherlands and Ireland come after, with 40.3 percent and 38.3 percent preference rates, respectively.

Strategic insights from Chinese brands

Cultural and nutritional preferences

Chinese infant formula products are tailored to local preferences and nutritional requirements. They are formulated based on extensive research into Chinese breast milk and the unique nutritional needs of Chinese infants. Foreign brands need to overcome the challenge of aligning their products with these preferences and effectively communicating the suitability and benefits of their offerings to the Chinese consumer base.

Market penetration strategies

Chinese domestic brands have excelled in expanding their market share through the Mother-and-Baby Store (MBS) channel, especially in lower-tier cities. This distribution strategy is deeply rooted in local consumer behavior and preferences. Foreign brands must carefully devise strategies to effectively penetrate this channel or identify alternative distribution channels that resonate with the Chinese audience. Failure to do so could hinder their ability to access a substantial portion of the market.

Branding and marketing

The Chinese infant formula market is highly competitive in terms of branding and marketing. Domestic brands have made substantial investments in marketing activities, such as product placement and celebrity endorsements, leveraging the familiarity and relatability of local personalities to build trust among consumers.

Foreign brands must develop culturally sensitive and impactful marketing campaigns that resonate with Chinese consumers while differentiating themselves from local competitors.

Market access

The infant formula market in China has not been without its share of challenges. A particularly noteworthy incident occurred in 2008 when a grave scandal erupted involving contaminated formula milk, shaking the foundation of consumer trust. The event involved the deliberate contamination of infant formula with a harmful chemical called melamine, which is typically used in plastics and fertilizers.

This incident underscored critical deficiencies in China's food safety regulations at the time, leaving its populace grappling with a crisis of confidence in domestically produced baby milk products. The Chinese government swiftly intervened by imposing stringent measures and safety standards for formula milk manufacturers, effectively overhauling the regulatory landscape.

Ever since, China has been implementing stricter safety requirements for its infant formula market.

Competent authorities and responsibilities

China's infant formula market is under the vigilant eye of several regulatory bodies, each with a distinct remit and responsibilities:

l State Administration for Market Regulation (SAMR): The SAMR, and in particular, the Special Food Safety Supervision and Management Department under it, is responsible for market supervision and administration, including overseeing special food categories like infant formula and managing recipe registration.

l National Health Commission (NHC): This body is tasked with drafting national standards, registering new food ingredients, and contributing to the overall food safety landscape.

l General Administration of Customs of China (GACC): This body manages customs inspection, quarantine, and declaration for imported infant formula products, ensuring adherence to safety requirements. Overseas food manufacturer registration also falls under their purview.

Recipe registration of infant formula products

Since January 1, 2018, all infant formula products, whether manufactured in China or imported into the country, are required to obtain a registration certificate from the competent department under the SAMR. The registration number obtained must then be visibly displayed on the product’s label and instruction booklet.

Nutrient requirements for infant formula

China's National Food Safety Standards for Infant Formula Food (GB 10765-2021), National Food Safety Standards for Larger Infant Formula Food (GB 10766-2021), and National Food Safety Standards for Toddler Formula Food (GB 10767-2021) (hereinafter referred to as the "new national standards") feature revised ranges for essential nutrients, both minimum and maximum values.

Seizing opportunities in China's infant formula market

Meeting the rising demand for premium products

E-commerce and digital marketing strategies

Collaborations and partnerships

Please click the link below to access the report.

Relevant Link:https://www.china-briefing.com/news/entering-chinas-infant-formula-market-regulations-opportunities-and-challenges/

Source: China Briefing

Note: This article is compiled by Antion. Please indicate the source for reprint.