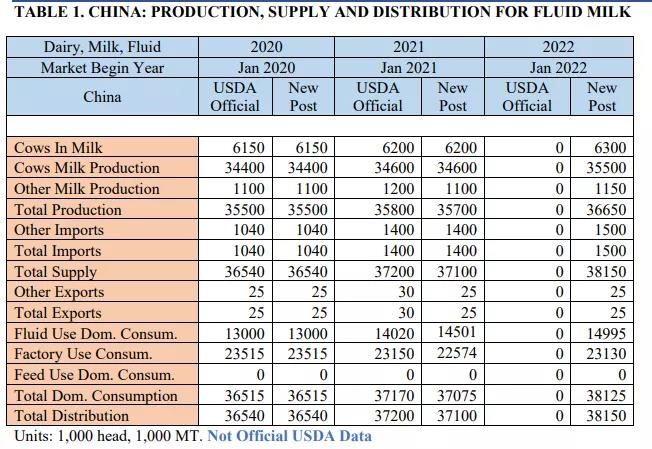

In 2022, China's raw milk production is forecast to reach 36.7 million metric tons, a 3 percent increase, as producers make operational investments that should return more milk, per cow milk production improves, and additional facilities come online. Whole milk powder beginning stocks and domestic production in 2022 will weigh on imports, which are forecast to decline 6 percent to 850 thousand metric tons. Imports of skim milk powder, cheese and butter are projected to grow to meet rising demand from the bakery sector, use in processed products, and retail consumers. In 2022, whey and whey related imports are forecast lower as infant birth rates decline and animal feed sector demand weakens on lower livestock/meat prices. FAS China proposed revisions to Posts cheese data series are included in this report.

Fluid milk

In 2022, China's raw milk production is forecast to reach 36.7 million metric tons (MMT), a 3 percent increase, as per cow milk production improves, additional dairy facilities come online and as the dairy herd expands. Milk imports in 2022 are forecast to grow by 7 percent to 1.5 MMT driven by demand for ultra-high temperature (UHT) milk, which dominates the imported fluid milk market.

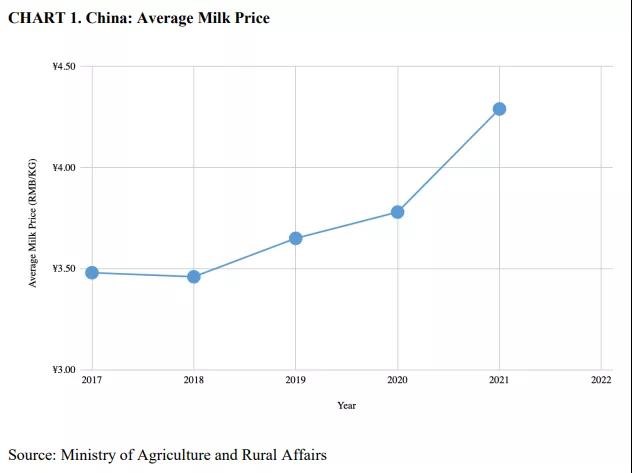

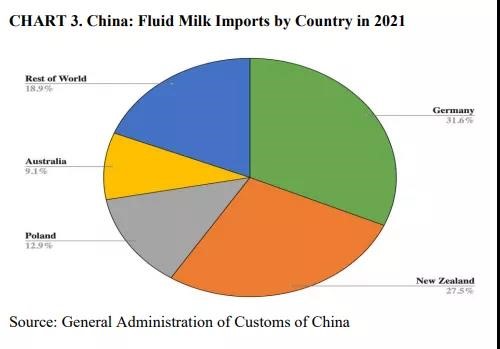

China's imports of fluid milk have seen continued growth since 2018 (see CHART 2). China's milk imports and milk consumption are dominated by pre-packed UHT milk. Imported UHT milk, which is considered a safe, high quality and a reliable product by Chinese consumers, is also competitively priced compared to domestically produced UHT milk.

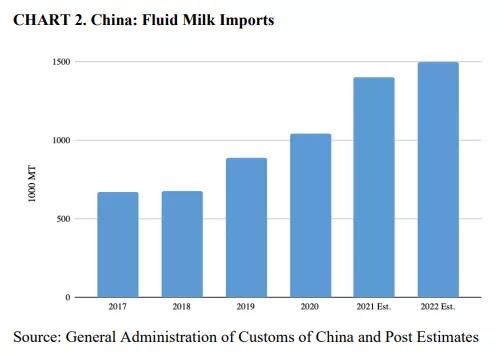

In 2021, Germany and New Zealand supplied more than half of all fluid milk imports to China (See CHART 3). In 2022, imports of fluid milk will grow but at a slower rate than past years. Poland’s market share is forecast to increase in 2022. Poland has invested in promoting dairy products and building a positive image targeted for the China market. This investment, competitively priced products, and an extended market presence has led to more long-term contracts with Chinese importers. Other market opportunities for imported products exist within the e-commerce marketplace. As more consumer purchases move online importers should consider utilizing these platforms to build awareness and brand recognition.

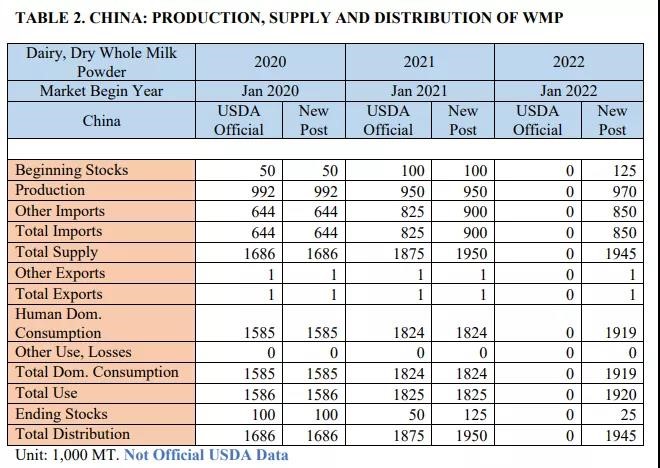

Whole Milk Powder

Whole milk powder (WMP) production in 2022 is forecast to increase gradually to 970 thousand metric tons (KMT) as raw milk production rises while higher input costs weigh down faster growth. In 2022, WMP imports are projected to decline 6 percent to 850 KMT as high beginning stocks and greater domestic WMP production limit continued import growth. While WMP imports are expected to decline slightly in 2022, imports are forecast at historically high levels as demand for bakery and processed products exceeds growth in domestic production.

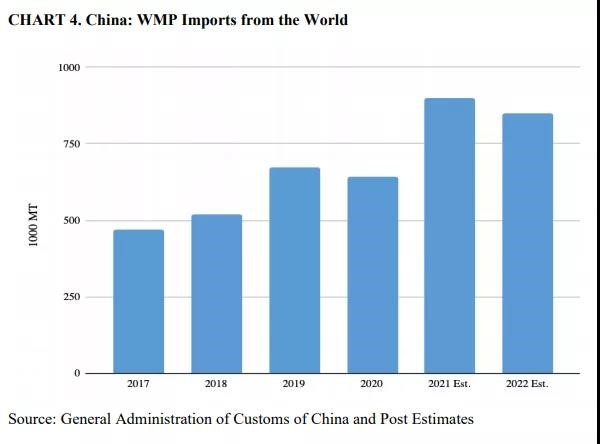

Imports of WMP are forecast to decline in 2022 from FAS China's revised estimate for 2021 imports as growth in WMP production and larger beginning stocks in 2022 lowered demand for imports (See CHART 4). Still, however, consumption remains strong. In 2021, WMP imports are estimated at 900 KMT due to competitive prices, high quality and desired characteristics, and strong demand from the bakery and processed product sectors. In 2022, New Zealand is expected to remain the dominant supplier of WMP to China. In 2021, New Zealand supplied over 90 percent of total WMP imports to China.

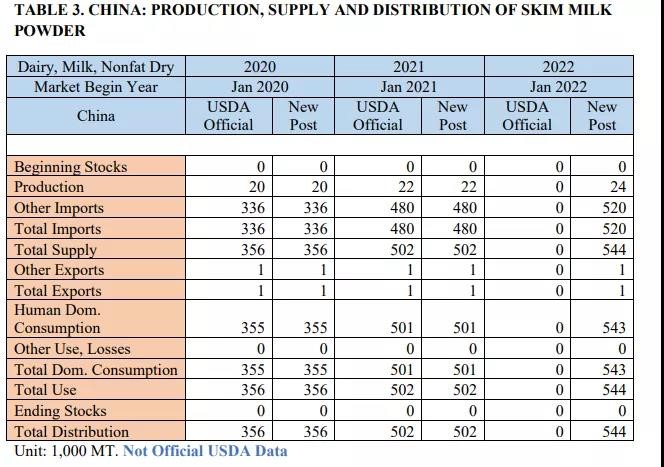

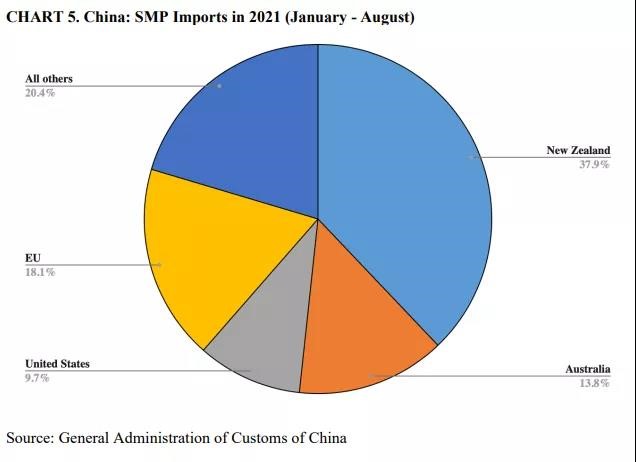

Skim Milk Powder

In 2022, China's skim milk powder (SMP) imports are forecast to rise 8 percent to 520 KMT. Demand from the bakery sector and low-fat food products is anticipated to support import growth. SMP domestic production is forecast to increase to 24 KMT, due to increases in cheese production. In China, SMP is a byproduct of cheese production. Domestic SMP accounts for a small percentage of overall SMP used in China.

Cheese

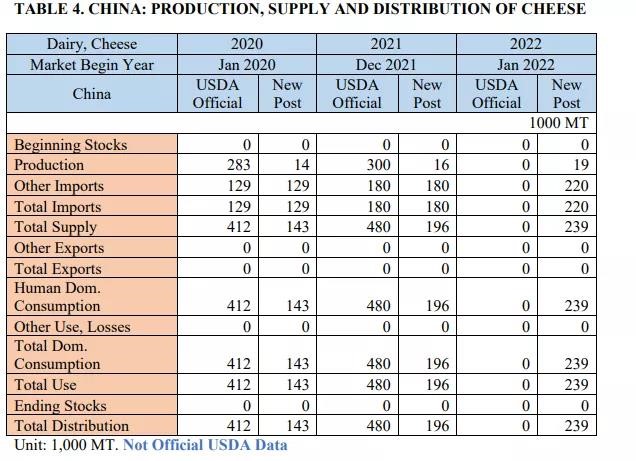

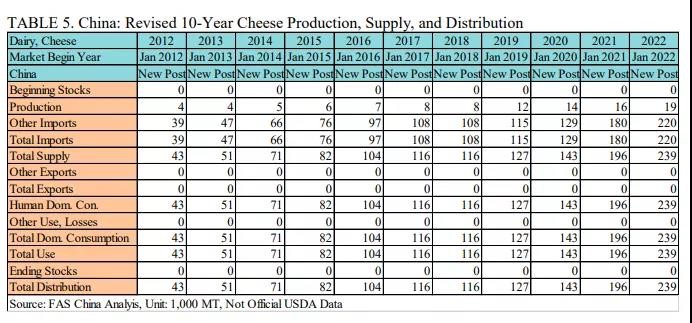

FAS China revised its data series for China's cheese production to account for the use of imported cheese as an ingredient in domestic cheese manufacturing. Imports of natural and processed cheese are forecast to climb to 220 KMT as demand for cheese in the hotel, restaurant, and institutional (HRI) service sector and as an ingredient in bakery products grows. Domestic cheese production is forecast to reach 19 KMT.

FAS China has proposed revisions to the data series for China's cheese production, supply, and distribution to account for imported cheese use as an ingredient in domestic cheese manufacturing.

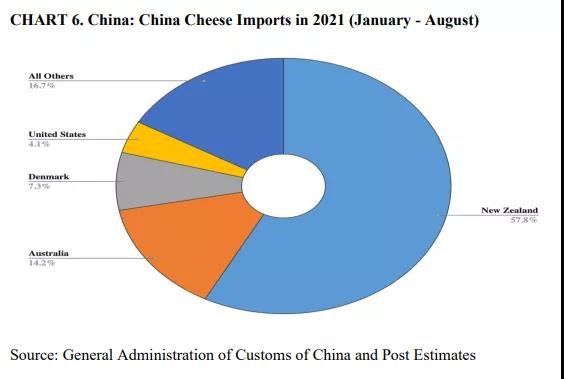

In 2022, imports of cheese products are forecast to reach 220 KMT as consumer demand drives growth. New Zealand is projected to remain the top supplier of cheese products to China (See CHART 6). New Zealand supplies more than half of the imported cheese products with well-developed brands, a dominant market share, and preferential tariff rates under a free trade agreement with China.

In 2021, the United States has seen growth in exports of fresh cheese, cheddar cheese and other processed cheeses, as an increasing number of products compete on quality and price with other cheese supplying countries. However, China maintains Section 301 retaliatory tariffs on U.S. dairy products, including cheese. Importers may apply for tariff exclusions, which are approved on a case-by-case basis. These exclusions do not automatically extend to all importers. For more information see Appendix section below.

In 2022, cold chain products could face disruption challenges within China. At the end of July 2021, local and provincial governments reacted to new COVID-19 outbreaks by implementing heightened inspections and/or testing for imported food, cold-chain products, port workers and truck drivers.

For dairy products requiring cold storage and temperature control, such as cheese and butter, importers should be aware of China's COVID-19 testing and disinfection measures. These measures will require importers, ports and clearing officials to adapt. However, adjustments to changes will likely cause added costs and delays for imported products.

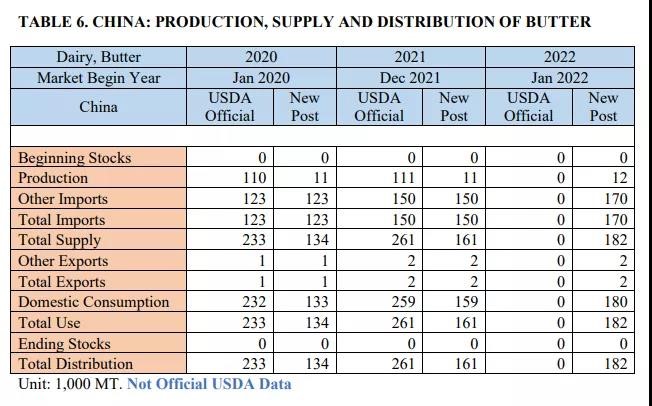

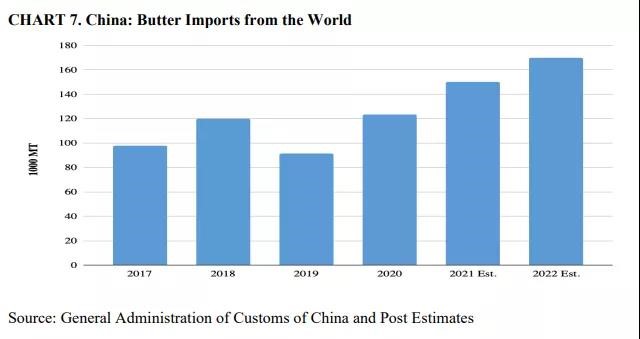

Butter

As the bakery sector expands, so has demand for high quality bakery ingredients such as butter. In 2022, China's butter imports are projected to reach 170 KMT as bakery, food services and at-home baking bolster consumption. China's domestic production is forecast to reach 12 KMT, due to larger quantities of raw milk, but butter production is constrained by limited production capacity and expertise.

In 2022, butter imports are forecast to reach 170 KMT to meet domestic demand. New Zealand dominates China's imported butter market with nearly 80 percent of the market share. Butter imports from the United States are forecast to see growth in 2022, based on a strong performance in 2021. In the first 8 months of 2021, butter imports from the United States grew 56 percent year-over-year.

Whey

In 2022, imports of whey and whey related products are expected to slow compared to 2021. Whey and whey related products are used as ingredients for infant formula products and animal feed. In 2022, declining birth rates and low hog prices are forecast to weigh on imports.

Whey and whey related products (HS040410, HS350220) are used as both feed additives and food additives. In 2021, imports of whey and modified whey products (HS040410) saw substantial annual growth of more than 30 percent, while HS350220 declined by 6 percent. Some industry contacts note that whey and whey products are used as an ingredient for infant formula and animal feed. The projected decline in China’s birth rate may slow the growth of whey imports. Furthermore, and possibly more importantly, declining hog prices in China will likely put additional pressure on hog feed prices that could result in less use of whey and whey products as a hog feed ingredient.

Please click https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Dairy%20and%20Products%20Annual_Beijing_China%20-%20People%27s%20Republic%20of_10-15-2021.pdf to access the report.

Source: FAS

Note: This article is compiled by Antion, please indicate our source if reprint it.